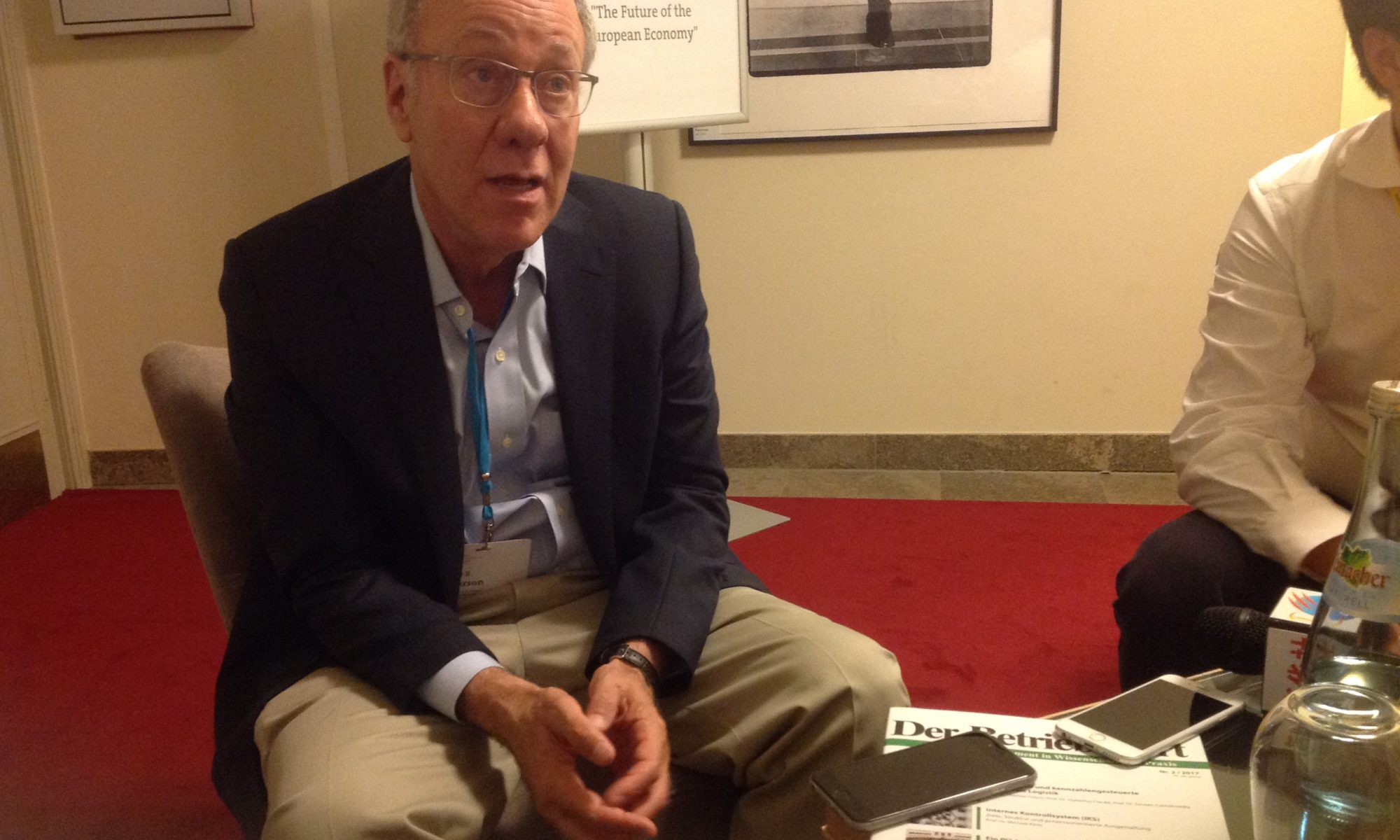

Interview mit Roger B. Myerson, Wirtschaftsnobelpreisträger

Im Sommer 2017 fand in Lindau am Bodensee das 6. Treffen der Nobelpreisträger für Wirtschaftswissenschaften statt. Dort versammelten sich 17 Laureaten aus aller Welt, die in den vergangenen Jahren diesen „Preis der Schwedischen Reichsbank für Wirtschaftswissenschaften im Gedenken an Alfred Nobel” erhalten hatten.

Prof. Roger B. Myerson, Wirtschaftswissenschaftler an der Universität von Chicago, nahm sich am Rande der Tagung Zeit für ein Pressegesgespräch, das er mit Zhonghao Shen, Korrespondent der Xinhua News Agency, und Regina Meier, „Der Betriebswirt“, führte.

Meier: I remember very well the last meeting at Lindau in 2014 when we spoke about macro-economics and politics, especially about Ukraine. Which threads do you see today for the world economy?

Meier: I remember very well the last meeting at Lindau in 2014 when we spoke about macro-economics and politics, especially about Ukraine. Which threads do you see today for the world economy?

Myerson: Ukraine is still an important frontier for liberal democracy. As an American who cares about Ukraine, I believe Ukraine should always be economically, culturally and perhaps in international relations close in line with the Russian people. I have the greatest hope for positive political development of that whole area including Russia. America should never try to bring Ukraine to the NATO unless Russia is also a part of the NATO. But there are also other challenges in the world: I‘m concerned about the European Union and also about political issues in the United States.

Shen: You have written a letter with other economists to the government of Trump. What is your opinion about what he is doing in the government?

Myerson: If I could get my country make to pay attention to me for 45 seconds, I would say please let’s never again elect someone to the presidency who has not held public power and served responsibility in some public office before we elect him to the highest office.

Donald Trump has no history of exercising public power or responsibility, this is a serious problem. He should have served as a governor of a state for four years – like Ronald Reagan, who ran for governor first and then ran for president.

In the long run the stability of the constitution of a great presidential democracy depends on the individuals who rise for the highest office. They should first show some personal commitment to upholding the constitutional rules. In a presidential democracy it is particularly important that the President must show a deep understanding of and a personal commitment to the constitutional constraints on his office. That’s not something that Donald Trump has shown in his career as a businessman.

The other thing is the international view. The United States must stay reliable and predictable in the future. The global investors have a large part of their portfolios held in dollars, because the United States has long been recognized as the most stable and reliable government of the world and a predictable force in the world. Now we have a President who says that the United States should be less predictable in its international relations, and the result could be to decrease investors’ demand for US dollar debt, especially if the Republicans pass a tax cut that increases the federal deficit.

“The United States must stay reliable and predictable in the future.”

If such policies by the Trump administration give us a weak dollar, there may be some increase in American manufacturing jobs, as the President promised, but there would also be an inflationary increase in the cost of living for Americans. The high value of the dollar for the last generations was because of the reliability of the United States. Now we withdraw from the Paris accord for example, we are not a reliable partner any more. And the Americans should care about the value of the reputation.

Shen: There have been structure reforms made in China. Do you have an optimistic prospective for China?

Shen: There have been structure reforms made in China. Do you have an optimistic prospective for China?

Myerson: I actually don’t know what structural reforms are happening in China, I think this is a time when the leaders of the party in China are trying to consolidate the monopoly on power, and as an American who understands the benefits of multi-party democracy that concerns me.

The Chinese system is different. The Chinese communist party has done a good job of creating competitive firms but those firms are not independent, the party has influence in their policies, and government officials tend to be more involved in firms in China than in similar firms in Europe or America. I believe that Chinese confidence in their financial system is not based as much on financial accounting but depends more on political oversight of financial institutions. But this means that, if a loss of confidence comes, it’ will have political consequences. That is, if the Chinese financial institutions disappoint their investors that is going to be a political disappointment.

Shen: Do you think the rapid Chinese growth is the solution to China’s problems?

Myerson: The rapid growth over the past during the last 25 years in China is by any standards a great accomplishment of the Chinese government and was one of the best, probably the best thing for humanity in our lifetime, helping more people to gain more by any measure. But of course 10 % growth cannot continue forever. I think a slowing of growth is to be expected.

New investment is very elastic to the business environment and to the reputation to the municipality for providing a save place to invest. So a slowing of new investment imay reduce incentives for local governments to restrain corruption.

Meier: There are lot of efforts to strengthen sustainability not only in ecology but also in economics. What does sustainability mean to you? Does it play an important role in your research?

Myerson: Sustainability is everything in the long run. In some ways sustainability is proper government budgeting, is about making sure keeping the depths under control, sustainability of the current public services, the current tax system. But sustainability is also used to talk about environmental sustainability: there is a lot to be done about that. Lars Hansen just gave a good talk here in Lindau about the uncertainties in climate science and the impact of carbon. 1)

“The sustainability of our global environment clearly requires global cooperation.”

From what he said, I think we need models which put a positively probability on the idea in which carbon has no effect on global economies, because that is what the deniers say, and they need to see that carbon taxes to reduce emissions may be a prudent conservative policy, even if there is some chance that we might find it unnecessary. I strongly recommend William Nordhaus’s book, which is called „The Climate Casino“ 2) – the title itself is telling you that his analysis begins with the uncertainty about weather.

But given the serious possibility that carbon emissions may be devastating the global environment, it is a risk that demands a serious response. I deeply regret the withdrawal of the United States from the Paris climate accords, because the sustainability of our global environment clearly requires global cooperation. Developing such global cooperation is a game-theoretically difficult problem, and consistent leadership from the United States would have been very helpful.

– Ende des Interviews –

Hier gehts zur Druckfassung des Interview mit Roger B. Myerson

Vor der Wahl hatten sich die Nobelpreisträger zur Kandidatur von Donald Trump zu Wort gemeldet: home.uchicago.edu/rmyerson/nobelecon2016.pdf

1) Lars Peter Hansen: Wrestling With Uncertainty in Climate Economic Models, Lecture beim 6. Treffen der Wirtschaftsnobelpreisträger in Lindau 2017

2) William Nordhaus “The Climate Casino: Risk, Uncertainty, and Economics for a Warming World”, Yale University Press 2013